Crafting a narrative based on supply-demand data.

Crafting a narrative based on supply-demand data.

Hays’ service offering is far more extensive than simply spot recruitment. Its team supports enterprises with comprehensive recruitment strategies to help futureproof their workforces. As part of their 2024/2025 plan, raising awareness of this holistic service offering was a key element of the team’s content strategy. Hays asked us to review their plans and provide our expert guidance on how it could be improved.

Having worked with Hays for several months at this point, we had a good understanding of their business objectives and content creation workflow. They were producing a lot of great content. But it wasn’t gaining the desired traction.

One of our suggestions was to work smarter, not harder. We wanted them to reassess their content creation and content distribution efforts – and suggested an 80-20 rule. Essentially, for every piece of high-value content created, there needed be a clear plan to ensure it reaches the right people – at the right time. 80% of effort should be spent in marketing the content and choosing the best channels to maximise the chances of the target audience engaging with it.

The first piece of content the Hays team wanted to adopt this approach for was a report on the supply-demand gap.

Addressing the industry-wide concern of the supply-demand gap felt like a great content opportunity for Hays. The challenge was clear – technology was advancing faster than professionals could be trained, leading to fierce competition for skilled workers. But as a widely recognised issue – exasperated by the pace of digital transformation – it was already a ‘hot topic’.

We needed to find a way to advance the narrative and position Hays as part of the solution – the strategic problem solvers. We observed that content on the topic was rarely substantiated with data. So, Hays wanted to position itself as the go-to brand by providing data-driven insights into this pressing issue.

Despite it taking a little while to collect all the relevant information, it was a hugely valuable step that allowed us to deliver a comprehensive report. The dataset also came with a reassuring 85-95% confidence range.

Once we had the raw data, we moved it into spreadsheets and formatted the data to make it more digestible. We converted all the salaries (that were originally provided in their local currencies) into USD to standardise the data and make it easier to compare the cost of talent across different regions.

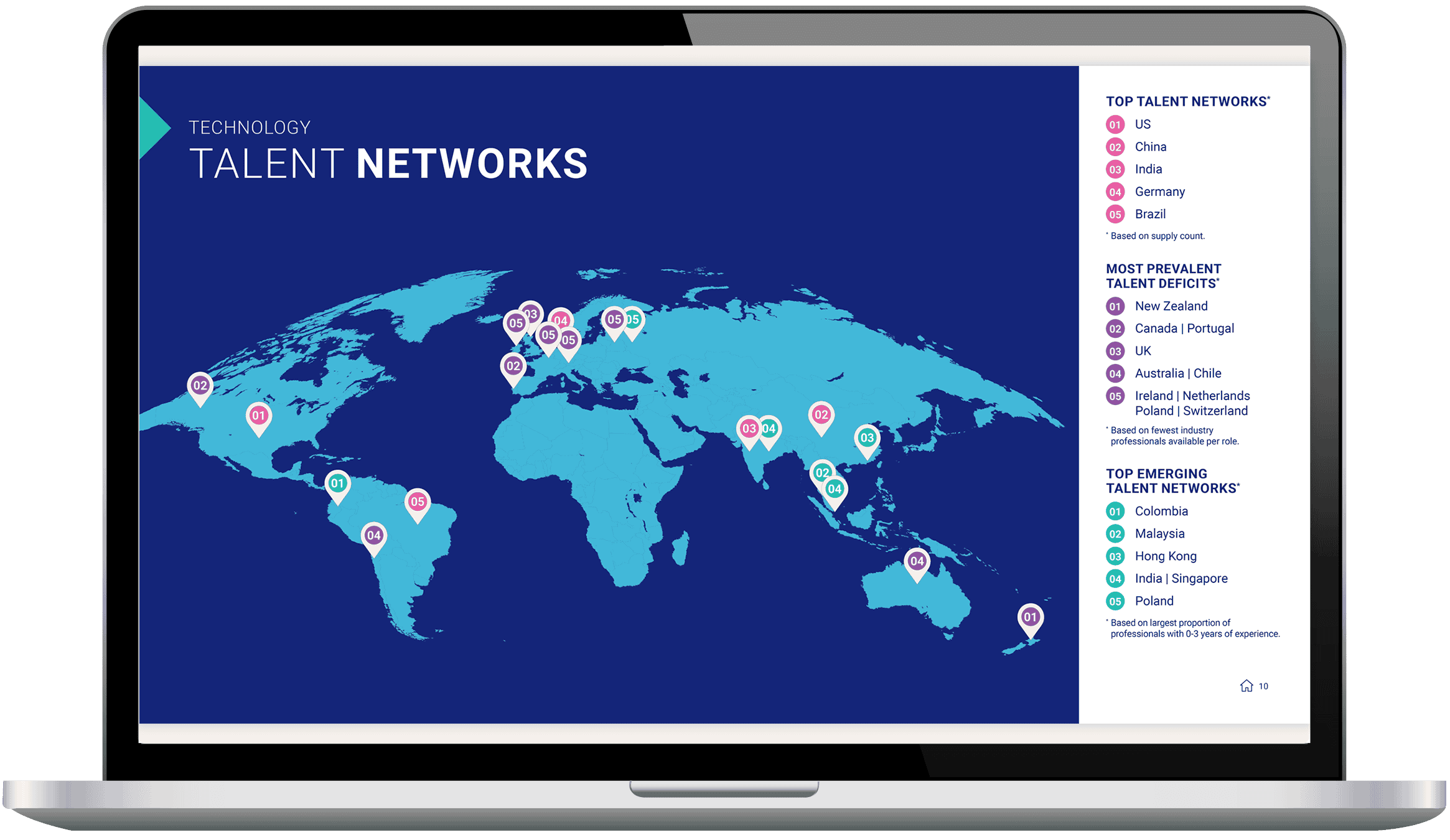

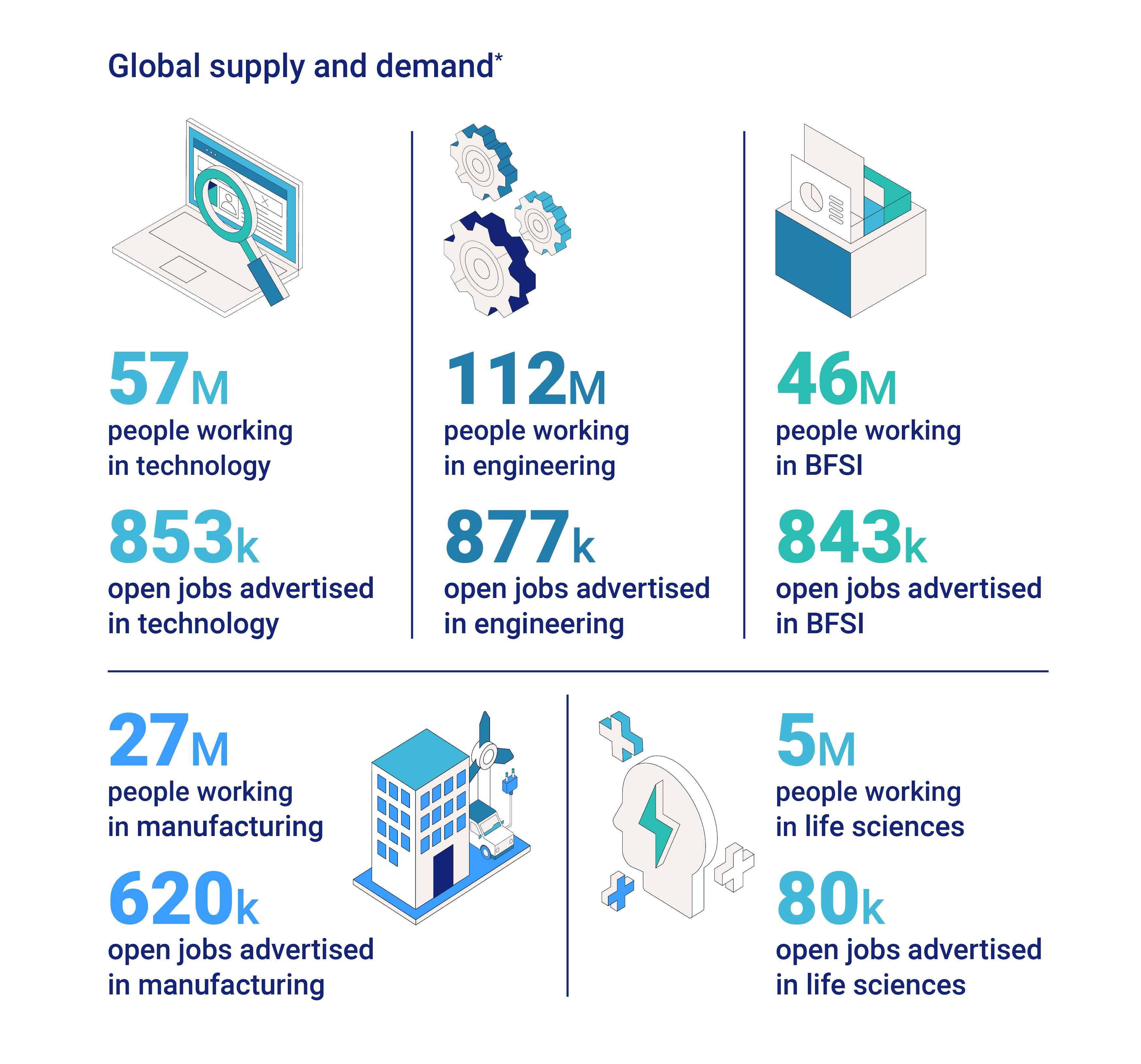

The team analysed the figures across five key industries and started to note some interesting findings. For instance, the number of candidates available per role, by region and industry. And how that correlated with years of experience. In essence, we were trying to determine which networks were investing in their pipelines, who was at risk of an ageing workforce, which networks were already stretched, and where future deficits were most likely to occur – based on the countries’ experience profiles.

To give us a clear direction for the report, we started with a succinct narrative, led by one key data point: Across the globe, and all five industries, there’s on average 13-20 candidates per role, which would suggest if talent was redistributed, we could resolve the supply-demand gap. Better still, this aligned nicely with Hays’ business strategy of encouraging their clients to apply a global lens to their talent search. As we got into the detail of the report, we built out this narrative to avoid oversimplifying the issue. Of course, it’s not quite that straightforward! But it was a good place to start and gave us a North Star.

Once we had this, we were able to create a detailed content outline, determining the flow, the supporting data points, and what relevant actionable advice would complement our findings.

To make the numbers more digestible, we created a suite of infographics. These showcased top-level supply-demand data and the top five countries for established talent, talent deficits, and emerging talent.

As the narrative started to take shape, we agreed that to really put Hays’ stamp on the report, we needed commentary and insights from Hays’ industry experts. To achieve this, we conducted internal stakeholder interviews with carefully selected experts from across the world. We wanted to ensure numerous countries were represented to further demonstrate Hays’ global footprint.

Together, we curated a list of top 10 job roles for each industry, cross-referencing the data with the experts’ real-world experience within their respective markets. We also leveraged their expertise to validate our findings and add further depth to the commentary.

The final report titled, The Workforce of the Future: Navigating the skills disruption, has been a huge success. Although it took longer than anticipated due to data-gathering delays, we quickly saw positive results.

Within the first 48 hours of its release, the report generated over 30 pieces of press coverage, including a top-five feature in The Evening Standard. Hays also achieved over 50% of their downloads target for Q1 within just two weeks.

Not only did this suggest there’s a high demand for this type of content, it also supported our hypothesis that an effective content distribution strategy was critical in making a piece of content successful. After all, if it’s undiscoverable, it can’t be valued by your target audience.

Hays was thrilled with the results. Ultimately, this project demonstrates the power of data storytelling. By turning complex figures into a relatable narrative, we helped Hays connect with their audience on a deeper level, while enhancing their profile and market position.